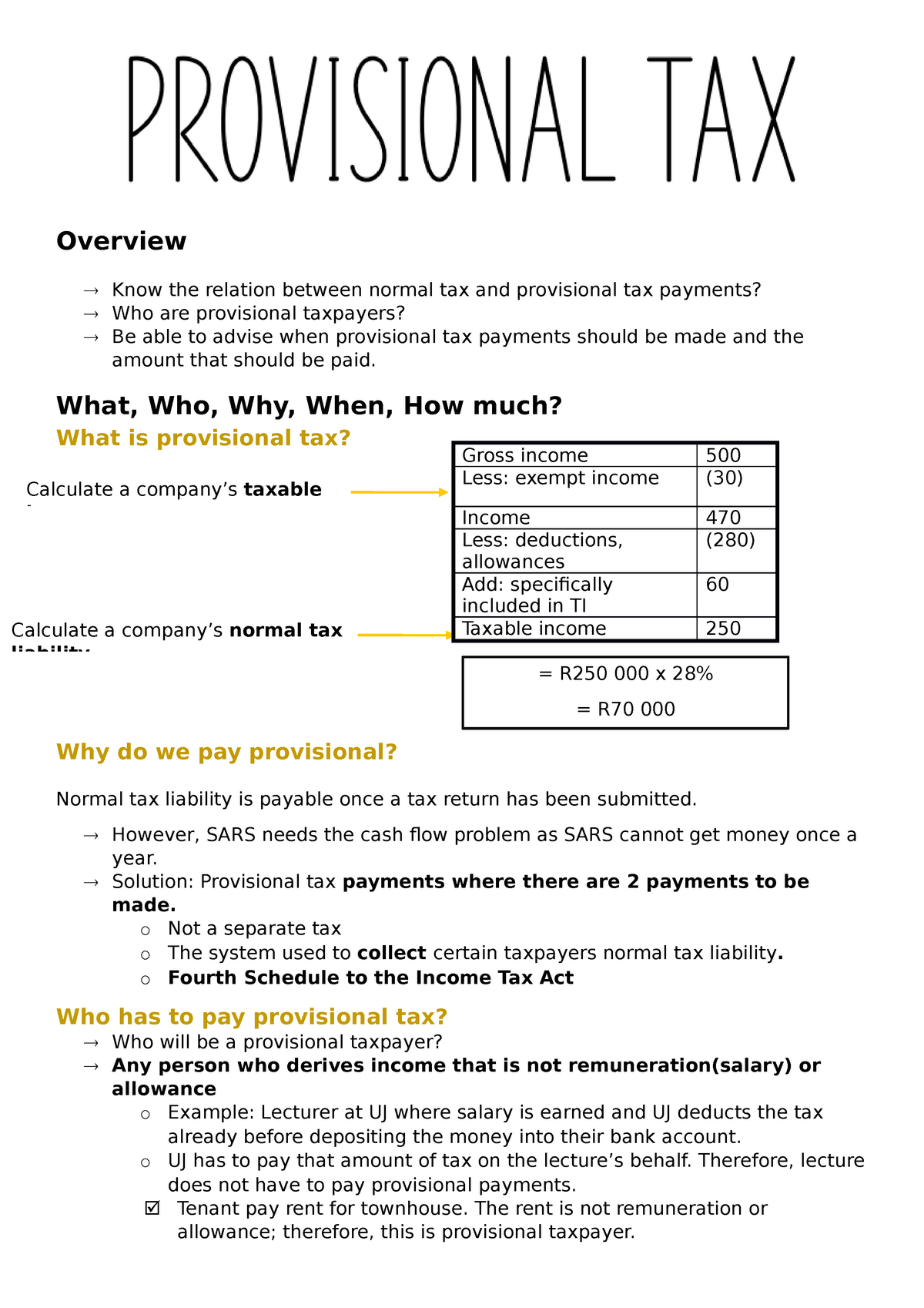

what is a provisional tax

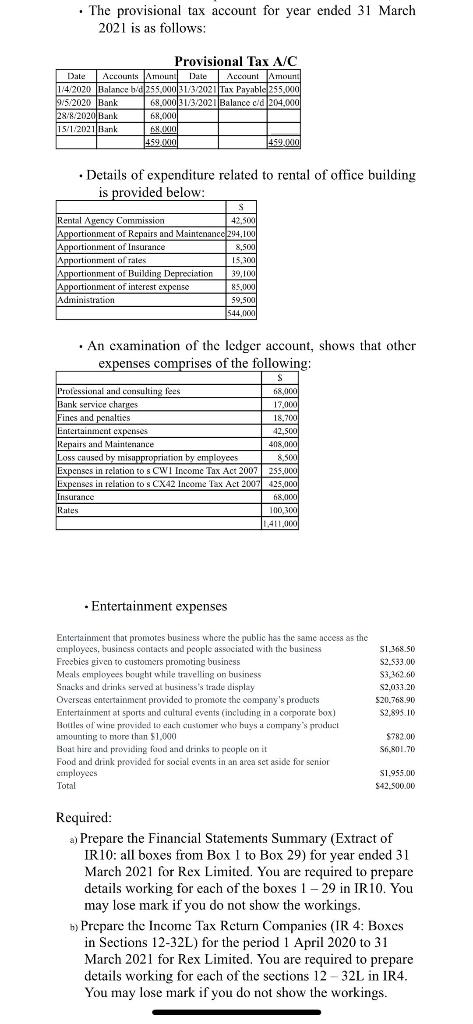

Provisional taxpayers have to submit their provisional tax returns twice a year. Provisional tax is income tax you pay in instalments during the year.

Core Tax Guide 2019 E Pages 51 66 Flip Pdf Download Fliphtml5

Provisional tax is not a special separate type of tax but simply a mechanism to pay your taxes during the tax year instead of having a large amount due to SARS on assessment.

. It is merely a system that requires taxpayers to provide for their final tax liability in advance by paying at least two amounts in the course of the year of. You pay it in instalments during the year instead of a lump sum at the end of the year. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of.

Provisional tax is not a separate tax. Provisional tax helps you manage your income tax. Provisional taxpayers are basically individuals or companies who earn business income.

3 rows Your provisional income is a combination of your adjusted gross income any tax-exempt income. Who is a Provisional Taxpayer. Nov 29 2021.

The provisional tax return is called an IRP6. Natural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or. Provisional tax is not a separate tax.

Everyone pays income tax if they earn income. They do not pay tax on it until the end of the year. By paying the amounts due in terms of the provisional tax.

The purpose of provisional tax is to allow a taxpayer to pay income tax during the tax year in which the income is earned. Provisional tax is a system that ensures you declare and pay income tax during a tax year and not only when your income tax return is assessed at the end of the tax year. What is provisional tax.

Youll have to pay provisional tax if you had to. This is done because there. Youll have to pay provisional tax if you had to pay more than 5000 tax at the end of the year from your last return.

The first return should be submitted 6 months after. Is provisional tax compulsory. Self Employed people rental property.

What is Provisional Tax. Provisional tax is not a separate form of tax. 2500 before the 2020.

Provisional tax can be explained as an advance payment made to offset against the Income Tax Liability for the respective year of assessment. Provisional tax can be explained as an advance payment made to offset against the income tax liability for the respective year of assessment. It is in fact one of the methods used by the South African Revenue Service SARS to collect tax.

Provisional tax is not a separate tax. This assists taxpayers in lessening. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of.

According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the previous.

Provisional Tax 2021 Dinos Antoniou Co Ltd Certified Public Accountants

![]()

Stream Episode Provisional Tax Use Of Money Interest Time For A Residential Land Value Tax More By The Week In Tax Podcast Listen Online For Free On Soundcloud

The Provisional Tax Account For Year Ended 31 March Chegg Com

Paye And Provisional Tax Payments 2007 2008 2016 2017 Download Scientific Diagram

Provisional Tax 03 Top Up Company Creative Cfo

Extension Of The Deadline For Submission Of Td7s And Td1s And Of The Deadline For Settlement Of The 2nd Instalment Of 2020 Provisional Tax Arosal Business Tax Consultants

The Basics Of Provisional Tax Estimates Provisional Tax Penalties And Interest Fhbc

Notes On Provisional Tax Overview Know The Relation Between Normal Tax And Provisional Tax Studocu

South African Provisional Tax Guide First Payment Youtube

Provisional Tax 202301 Virtual Tax Accounitng

Bluemeg Consulting Provisional Tax Payer Should You Give Heed To The Deadlines

Hdi Group Provisional Tax Time The First Provisional Tax Return For All February Year Ends Is Due At The End Of August 2021 For The 2021 2022 Period Submit And Pay On

Provisional Income Tax Due 26 February Do S And Don Ts For Companies Vision Magazine Online

Scorpion Legal Protection Provisional Taxpayer Provisional Taxpayers Are People Who Earn Income Which Is Not Remuneration Like Wages Or A Salary If You Get Income From A Business Or Trade

Provisional Tax Rules In For A Shake Up Maya On Money